Buying A Car In New York State? There Is Good News

Most people will tell you that the two biggest investments that they have made, or plan to make, are a house and car. The housing market has been tough on buyers as the prices have been through the roof, and now the interest rates are nuts! As for cars, who can you trust and what about the funds to actually buy it?

The price of cars and specifically used cars also went up considerably during the COVID-19 pandemic. In fact, the trade in money was also big! Many times, dealers were paying you back as much as you originally paid for your new car! And selling it for even more! The lack of new inventory forced the prices to skyrocket.

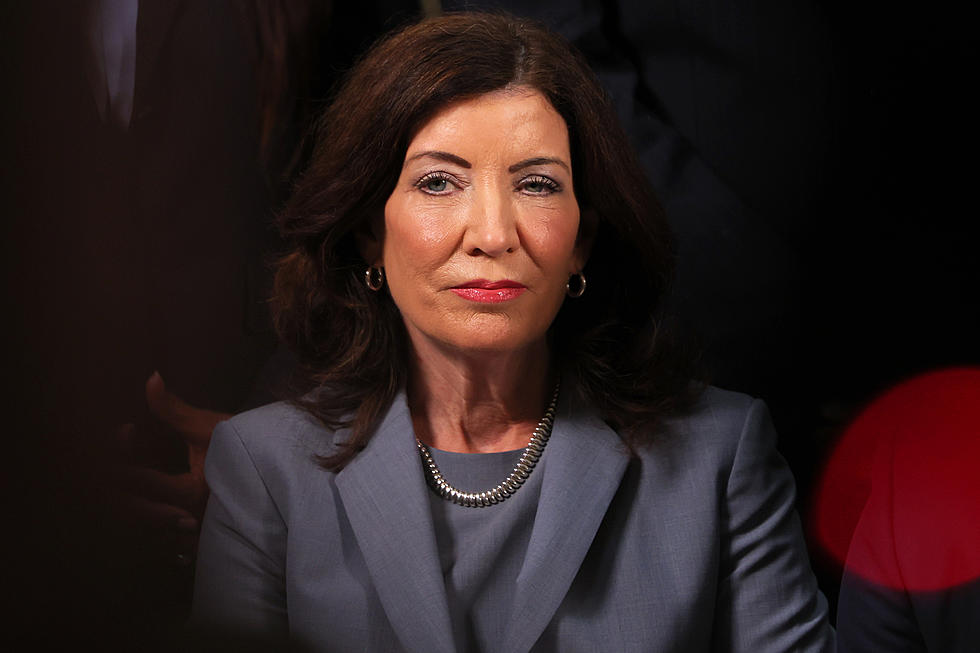

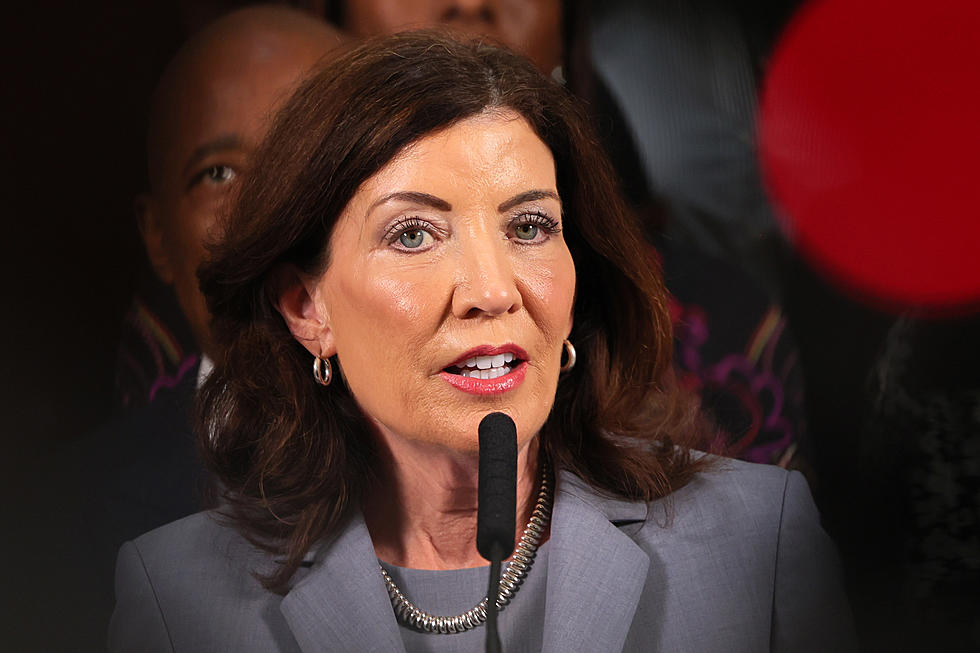

There is good news for those shopping for a car in New York State. The head attorney in the state is going after those who are trying to take advantage of low income buyers in 2023.

According to reports, NY's Attorney General's Office and Consumer Financial Protection Bureau are teaming up to take legal action against Credit Acceptance Corporation which is one of the largest subprime auto lenders in the country. Officials claim that CAC deceived low-income New Yorkers into high-interest car loans without considering whether people would be able to repay their loans in full.

CAC markets itself as an alternative to traditional lenders, a bridge for low-income individuals to buy a car and build up asset-based wealth. Between 2015 and 2021, the income of the median borrower nationwide was about $35,000.

There is no feeling like buying a car, especially your first car. That shouldn't come with a hidden hardship that will set you back beyond the life of the vehicle.

READ ON: See the States Where People Live the Longest

LOOK: The most extreme temperatures in the history of every state

More From 106.5 WYRK